Islamic banking is a system of banking that operates in accordance with Islamic law, also known as shariah. The objective of Islamic banking is to provide financial services and products that are ethical, sustainable, and socially responsible. The principles of Islamic banking are rooted in the Islamic faith, which emphasizes social justice, equality, and mutual cooperation.

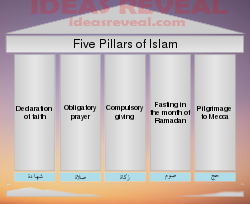

There

are five main pillars of Islamic banking, each of which is an essential

component of the Islamic banking system. In this article, we will explore these

pillars and explain their significance in the context of Islamic banking.

Prohibition of Interest (Riba)

The

first pillar of Islamic banking is the prohibition of interest, also known as

riba. In Islamic law, riba refers to any kind of interest or excess payment on

a loan. The concept of riba is based on the belief that money should not be

treated as a commodity that can be bought and sold at a profit. Instead, money

is seen as a medium of exchange that should be used to facilitate economic

activity and promote social welfare.

The

prohibition of riba has a significant impact on the way Islamic banks operate.

Instead of charging interest on loans, Islamic banks offer financing through

profit and loss sharing (PLS) arrangements. Under a PLS arrangement, the bank

and the borrower share the profits and losses of a project or investment. This

approach aligns the interests of the bank and the borrower, as both parties

have a stake in the success of the project.

Risk-Sharing (Mudarabah)

The

second pillar of Islamic banking is risk-sharing, also known as mudarabah. This

principle refers to the sharing of risk and reward between the bank and the

borrower. In a mudarabah arrangement, the bank provides the capital for a

project or investment, while the borrower provides the expertise and labor. The

profits generated from the project are shared between the bank and the borrower

according to a pre-agreed ratio.

The

principle of mudarabah is based on the belief that risk should be shared

between the parties involved in a project or investment. This approach

encourages entrepreneurship and innovation, as both the bank and the borrower

are incentivized to work together to generate profits.

Asset Backing (Takaful)

The

third pillar of Islamic banking is asset backing, also known as takaful. This

principle refers to the requirement that all financial transactions must be

backed by tangible assets. This means that Islamic banks are required to invest

in real assets such as property, commodities, and infrastructure projects,

rather than engaging in speculative or high-risk investments.

The

principle of takaful is based on the belief that financial transactions should

be backed by real assets that have intrinsic value. This approach promotes

stability and sustainability in the banking system, as it ensures that banks

are investing in assets that have a tangible economic benefit.

Ethical Investment (Halal)

The

fourth pillar of Islamic banking is ethical investment, also known as halal.

This principle refers to the requirement that all investments and financial

transactions must be conducted in accordance with Islamic law. This means that

Islamic banks cannot invest in industries that are considered haram

(forbidden), such as alcohol, tobacco, gambling, and weapons.

The

principle of halal is based on the belief that financial transactions should be

conducted in a way that is consistent with Islamic values and ethics. This

approach promotes social responsibility and sustainability in the banking

system, as it encourages banks to invest in industries that have a positive

impact on society and the environment.

Social Responsibility (Zakat)

The

fifth and final pillar of Islamic banking is social responsibility, also known

as zakat. This principle refers to the obligation of Muslims to give a portion

of their wealth to those in need. Islamic banks are required to distribute a

portion of their profits to charitable causes in the form of zakat or other

forms of charitable giving.

The

principle of zakat is based on the belief that wealth is a blessing from Allah

and that it should be shared with those who are less fortunate. This approach

promotes social justice and equality in the banking system, as it ensures that

a portion of the wealth generated by the banks is used to benefit the wider

community.

The Five Pillars in Practice

In

practice, the five pillars of Islamic banking are applied in a variety of ways

by Islamic banks around the world. For example, some Islamic banks offer a

range of financial products and services that are compliant with Islamic law,

including savings accounts, checking accounts, and home financing. These

products are designed to provide customers with access to financial services

that are consistent with their religious beliefs and values.

Islamic

banks also use a range of financing structures to provide financing to their

customers. Some of the most common structures include murabaha, which is a

cost-plus financing structure that is commonly used for home financing, and

ijara, which is a lease-based financing structure that is commonly used for

equipment financing.

In

addition to these financing structures, Islamic banks also offer a range of

investment products that are designed to provide customers with access to

shariah-compliant investment opportunities. These products include mutual

funds, real estate investment trusts (REITs), and sukuk (Islamic bonds).

Challenges and

Opportunities

While

the principles of Islamic banking have been in place for centuries, the modern

Islamic banking industry is relatively new and still evolving. As the industry

continues to grow, there are a number of challenges and opportunities that will

need to be addressed.

One

of the biggest challenges facing the Islamic banking industry is the lack of

standardization in the interpretation and application of shariah law. While

there are a number of shariah boards and councils that provide guidance on

shariah-compliant banking practices, there is still a great deal of variation

in the way these principles are applied in practice.

Another

challenge facing the Islamic banking industry is the limited availability of

qualified shariah scholars and practitioners. To ensure that shariah-compliant

financial products and services are developed and implemented in a consistent

and accurate manner, there is a need for a greater number of trained shariah

scholars and practitioners.

Despite

these challenges, the Islamic banking industry presents a number of

opportunities for growth and development. One of the biggest opportunities is

the growing demand for shariah-compliant financial products and services, both

in Muslim-majority countries and in non-Muslim-majority countries.

Another

opportunity is the potential for Islamic banking to play a greater role in

promoting sustainable and socially responsible investment. With its focus on

asset backing, ethical investment, and social responsibility, Islamic banking

is well positioned to play a leading role in promoting sustainable investment

and responsible business practices.

Conclusion

The

Five Pillars of Islamic banking provide a framework for the development of a

financial system that is ethical, sustainable, and socially responsible. These

principles are based on the core values of the Islamic faith, including social

justice, equality, and mutual cooperation.

In

practice, Islamic banking offers a range of financial products and services

that are designed to provide customers with access to shariah-compliant

financial services and investment opportunities. While the industry faces a

number of challenges, there are also significant opportunities for growth and

development in the years ahead.

As

the Islamic banking industry continues to evolve, it will be important for all

stakeholders to work together to promote the development of a financial system

that is grounded in the principles of ethical and socially responsible finance.

By working together, we can create a financial system that supports the

well-being and prosperity of all people, regardless of their religious or

cultural background.

0 Comments